Keep Access. Put your talents to work. Rinse, Repeat, Compound.

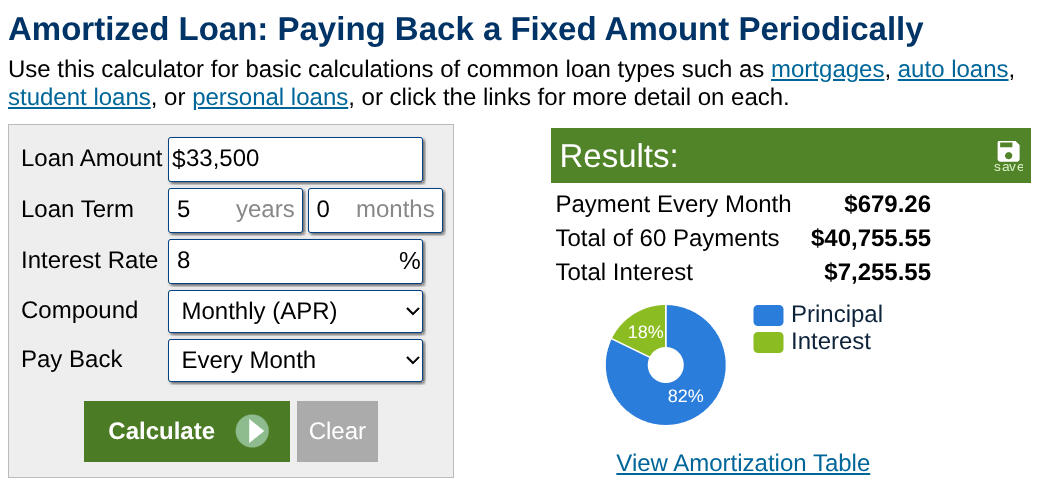

We are constantly being told to "invest, invest, invest," and often times we are doubtful if the stock market will improve our financial situation in the best way.It actually comes to a point that we hear the words "Save" and "Invest" basically interchangeably.They both connote some sort of idea that having some money compounds into more money. Like everyone says, "so that your money will work for you." Or as Albert Einstein said, "Compound interest is the eighth wonder of the world. He who understands it, earns it. He who doesn’t, pays it.”But could there, perhaps, be a key difference between the two?Yes.It's in the word.When a person saves, he has "saved" money for himself. He may use it at anytime.When a person "invests," he has given the money over to some third party, in hopes for a return sometime down the road. He has given the "control" of the money to someone else. And he needs their permission and their rule-book if he wants to get it back.Why is having control of the asset important? Because strategically speaking, If we have full access to savings, it is able to be "leveraged" to achieve more wealth when a good opportunity arises (more on that below). Investments, on the other hand, need to be first "freed from captivity," and at whatever price that comes, and then repurposed.At DIY SaveWealth, we consider that often times the greatest Return on Investment (ROI) a person will ever see is through their own endeavors. Through the use of their own, God-given talents.Some have a talent for business.Some for making smart purchases.Some have real talent such art or music. Or perhaps sought after skills, like tech, and marketing.In a large majority of cases, when a person is hard-working, and has discipline, we are able to help them leverage their savings and stand ready for opportunity, growth and in safety.LeverageDid you know what's the best way to buy a car? Or make any business venture or investment for that matter?Of course, everyone knows. Pay cash, right?That's pretty easy to see when you look at what conventional lending looks like:The following example shows you the difference between the "rate" of interest (what everyone talks about), and the actual amount of dollars of interest paid, by volume, over the life of the loan.

On a car loan with an APR of 8%, when paid monthly over 5 years, in fact 18% of total dollars paid went towards interest.That's a lot more than 8%!That 18% includes an opportunity cost as well. Had it been saved, it could have been repurposed or re-compounded for more gains.So obviously cash is much better than conventional lending. When you pay cash, there is no interest is paid.Amazing.But... actually... there's a little more to it than that.The very act of spending cash carries a cost of its own as well. That again, is an "opportunity cost." And this is where leveraging savings, as opposed to spending savings is different.There is a story of two twin sisters. They are both 30 years of age. Each have disciplined saving habits. One saves money using a conventional product of CD's (certificates of deposit) with a bank and then pays cash outright for the car after 5 years of investing in CD's.The other sister uses a strategy we call "infinite Banking" to save money inside of a whole life insurance policy. She saves the same money inside of her policy for 5 years, and then uses a policy loan from the life insurance policy to buy the car outright.And let's say this pattern repeats itself, they both do exactly the same thing, saving the same amount of money each year, each with their own disciplined saving strategy, and then buying a new car every 5 years. Who do you think comes out ahead at the end of the day?If you guessed the sister using infinite Banking, you're right!

What we do

We work with businesses and individuals who want to take control (literally) in their financial lives. Our clients live a much more worry free life, independent of the ups and downs of the market, with tax free access to their money and predictable results.We are an independent firm, checking among all top carriers for the best fit to suit individual preference in style of personal "banking" strategy wished to employ. A simple understanding of the basic principals have literally an infinite number of applications across the differing fields. A wide variety of clientele find value in the concept:* Entrepreneurs and Business Owners: They can use IBC to access capital for business needs, fund growth, and secure their legacies. IBC can act as a financial safety net, providing liquidity for business needs.* Real Estate Investors: IBC can provide a readily available source of funds for investment opportunities, allowing quick action on potential deals.* Fiscally Responsible Savers: Individuals who are disciplined with their finances and have a long-term perspective on wealth building find IBC's emphasis on consistent saving attractive.* Risk-Averse Retirees (and Pre-Retirees): For those nearing or in retirement who want to protect their wealth and generate tax-advantaged income, IBC can be a suitable strategy.* High-Income Earners: Physicians and other high-income professionals can utilize IBC to manage their wealth, minimize taxes, and access funds for major purchases.* Individuals seeking financial independence: IBC offers a way to bypass traditional banking institutions and create a personal banking system, putting you in control of your financial transactions and reducing reliance on external lenders.

About

Benjamin (Binyamin) Mills lives in Coral Springs, FL and enjoys doing outings in nature with family. Fresh air from 2 coasts always blow over the Florida peninsula, and makes for great hikes, beach play days, and canoeing.Benjamin is passionate about getting his clients the best advice to design a financial plan for their life, to reach their goals and mesh with their preferences.

Other Services

We have a full team of experts including lawyers and CPAs who can advise in these matters as well as in regards to insurance products, securities, and annuities.

If you would like to learn more about how and if this could work for you, please get in touch with us using the form below:

Phone: 954-324-7220

Email: [email protected]

Office: 2424 N Federal Hwy #318, Boca Raton, FL 33431

Looking for monthly updates?

Sign up for our emails and keep up with the most innovative tips on how businesses, investors and individuals are using these concepts to stay ahead of the curve and grow their wealth!

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.